This manual will help you understand how the MarketMonitor bot works, which is equipped with various crypto exchange screeners. The bot is capable of opening positions on the futures market and buying coins on the spot market in both manual and automatic modes.

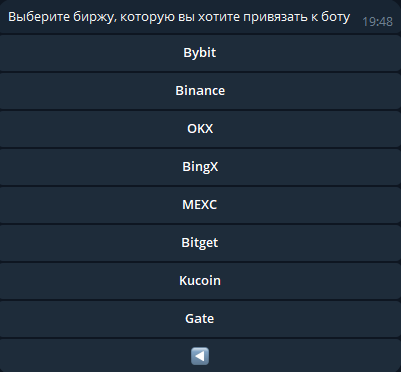

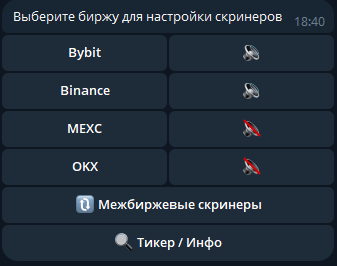

Important! In the free version, only manual retrieval of information for the required ticker is available to you (more details below). Intra-exchange screeners and auto-trading are provided under available subscriptions. If you are a beginner in trading, it is recommended to first study basic exchange concepts and try trading manually before purchasing a subscription and mastering the bot interface. Intra-exchange screeners have flexible settings and allow you to filter data by various parameters: coin names, capitalization, price change, volume, open interest (OI), RSI, and funding. The bot is under active development, so some functions may not yet be described in the instructions. Currently, it scans 8 exchanges: Binance, Bitget, Bybit, Mexc, Okx, BingX, Kucoin, and Gate. Intra-exchange screeners and trading are supported on Bybit, Binance, OKX, and Mexc (the trading API on the exchange side has not been implemented here yet). Exchange data is updated in real time via WebSocket streams, and order tracking is implemented through them as well. This allows the bot to react instantly to all events occurring on the exchange.

Let's move on to the settings:

A Brief Introduction: How to Use the Bot Correctly?

It is no secret that the world today is a rather unstable and constantly changing place, making it difficult to control and even harder to predict using fundamental analysis. Most crypto traders have felt the impact of recent events on their own wallets (shout out to everyone who got liquidated during the attack on Israel in April 2024—the author was right there with you). In such conditions, relying on complex indicators like Elliott Waves, Bollinger Bands, Ichimoku Clouds, or MACD often feels like playing at a casino.

In our bot, we focus specifically on current exchange metrics, such as:

Price, Open Interest (OI), Volume, Funding, and Liquidations. By comparing these and applying filters (like RSI or Market Cap), we try to forecast future coin movements based on simple analysis.

For example:

Price jumps, but OI and Volume drop? This means long holders are closing positions and taking profits—a potential short opportunity.

Price rises along with all other indicators? We are likely looking at an upward trend—a potential long opportunity.

Daily RSI is over 90%, hourly is at 40%, and funding is skyrocketing? The coin was heavily pumped in previous days and a correction is starting—consider opening a short on the next minor pump.

I intentionally do not provide specific values because markets and coins behave differently every day. And, of course, we cannot ignore frequent market manipulations, where a "whale" with tens of millions of dollars can ruin all our analytics with a single click—just because they didn't get enough sleep.I should emphasize that I highly recommend using filters (by market cap and coin names). Do not trade everything at once; it is impossible to apply a single strategy to over a thousand different coins. In my own strategies, I trade 5 high-liquidity coins, and some successful traders focus exclusively on just one!

Additionally, the bot offers flexible settings for managing current positions, such as:

Grid Take-Profits for partial profit fixing.

Moving Stops to Break-Even (BE) after partial profit.

Position Add-ons and flexible Averaging Logic.

Combined, these features provide an excellent tool that handles all the "dirty" exchange work for you. Finally, I would like to wish everyone success and profitable trades. I'll also share a small set of rules that I have developed for myself during my time in trading.

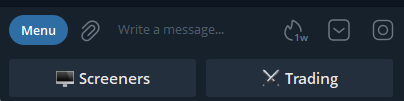

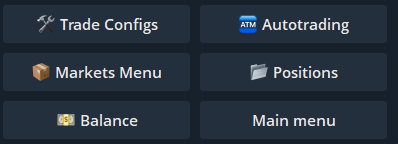

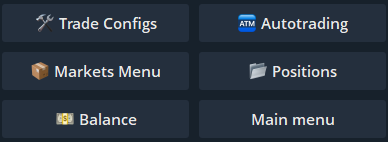

After pressing the /start button, a keyboard with two main sections will appear.

The Screeners section provides access to screener settings across multiple exchanges. These screeners monitor the markets and send signals that meet your specific parameters. Essentially, they act as your "eyes" on the market, helping you avoid opening positions blindly and instead wait for the perfect setup. The key advantage over any competitors is the availability of 8 different screeners, each with its own filters, as well as the ability to set unique configurations for different exchanges. Additionally, you can receive cross-exchange signals (price discrepancies, funding rates).

The Trading section allows you to link API keys from all available exchanges, configure entry parameters (supporting both long and short positions, which can be opened simultaneously), and execute trades using market or limit orders immediately upon receiving a signal—either manually or automatically via the bot.

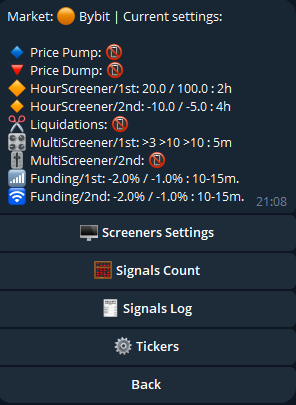

After clicking the button to select an exchange, the Main Menu will open. It contains several sections that we will examine in more detail below:

Frequently Asked Question: What parameters should I use?

Answer: It all depends on your strategy. The bot provides data, but there is no universal "holy grail" in crypto trading - the market is constantly changing. What works for one coin might not work for another, and strategies successful in one market condition may prove ineffective in another.

A trader's task is to identify setups and assets that provide at least a 50%+ win rate in the long run. Even a ratio of 51% take-profits to 49% stop-losses is already a formula for success (excluding exchange commissions).

As mentioned previously, the bot offers extensive capabilities for interacting with various exchanges and can be used for several different scenarios:

To use any of these features, you will need to generate API keys on the exchange and link them to the bot. It is important to note the following:

! By linking your keys, you grant the bot the ability to trade with your funds. The keys are managed by the user, and the specific permissions for account actions are also set by the user. You can delete keys and create new ones at any time; however, the user bears full responsibility for the safety of funds on the account. I recommend keeping this in mind and starting your trading with a minimum deposit to observe how the bot behaves in various scenarios.

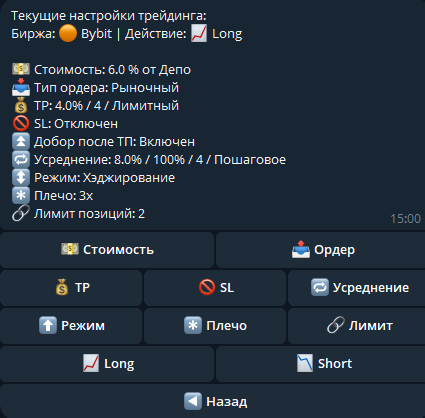

Let’s return to the main menu and select Trading. We will briefly go over the main elements found here, and a more detailed breakdown with examples will be provided below.

Now, let’s take a closer look at each item in more detail:

Please note that the settings for Long and Short positions are identical; the current selection is displayed after the Action button. For convenience, we will go through all the settings using Long positions as an example.

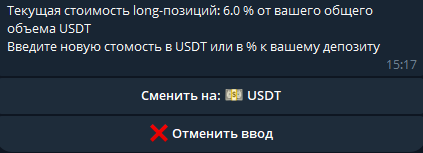

Opening position size: set either as a percentage of your total balance (available + in positions) or as a fixed amount in USDT. When configuring this, you enter the numerical value and then select the units (percentage or USDT) using the button in the drop-down message.

Order type for opening: limit or market. Trading with limit orders saves on fees and eliminates slippage. The downside is that there is no guarantee the position will open. In my experience, about 70–80% of orders are filled, depending on the signal type. Market orders open a position immediately, but the trade-offs include higher fees and slippage.

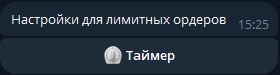

When a limit order is selected, two additional settings appear: Timer and Price Delta.

The Timer allows you to specify how long the bot should wait before canceling an unfilled order. This is necessary to avoid opening a position based on an outdated signal when the market situation has already changed.

The Price Delta allows you to "shift" the order placement by a certain percentage from the contract price indicated in the signal. You can move it up (using a positive value) to increase the chances of the position opening, even if it slightly worsens the entry point. Alternatively, you can move it down (using a negative value) if you expect the price to continue dropping after the signal is received.

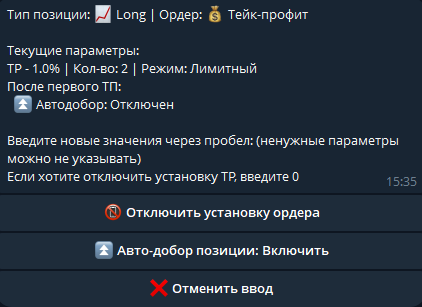

This setting provides flexible management of take-profit orders and their behavior. When configuring, you need to specify from 1 to 3 parameters.The first parameter indicates at what level (in % from the entry price) the order should be placed.With the second value, you can specify the number of TP orders (up to 5). In this case, the position will be divided into equal parts, and the TP orders will be placed at equal intervals from each other. The default value is 1 order.The third value sets the trailing (slippage) for the TP order. The default is 0, in which case the TP will be a limit order. If you explicitly set this third parameter, the TP will open as a trigger order, and the specified value will act as a callback from the best price at which the order is triggered.

There is no need to dwell on a single TP order, as its logic is straightforward: when triggered, the entire position is closed. The behavior of a grid TP is slightly different: when one of the grid orders is filled, the position volume decreases as a portion of it is closed.

The bot accounts for this by automatically recalculating both the averaging orders (which are based on the current position volume) and the stop-loss order. This applies, of course, if these orders are set. Additionally, the logic for the stop-loss is directly tied to the execution of grid TP orders, which will be covered in the corresponding section.

The Refill feature can significantly improve your trading results. Its logic is as follows: after one of the grid TP orders is triggered and a portion of the position is closed, a limit order is placed to refill that same volume back into the position.

The placement price is calculated from your entry price (EP): EP minus deviation (or EP plus deviation for shorts). If the deviation is set to 0, the order is placed exactly at the entry price. When the next grid TP triggers, the previous refill order is canceled and replaced by a new one that accounts for the combined volume of both triggered TP orders. This cycle continues until the position is fully closed.

If the price moves back and the auto-add order is filled, the current entry price of the position improves. This leads to a repositioning and recalculation of the averaging grid while maintaining the remaining number of averaging steps. For example, if 1 out of 4 averaging orders had been used, the new grid will be recalculated based on the 3 remaining orders.

Why use this feature?

It allows you to gradually shift your position to a more favorable entry point as the price fluctuates within a channel-acting like mini-averaging trades. Additionally, it enables you to consistently lock in profits through grid TPs. Most importantly, this feature does not increase the overall risk of the position, as the logic only activates after a grid TP has triggered (i.e., when the position is being deleveraged).

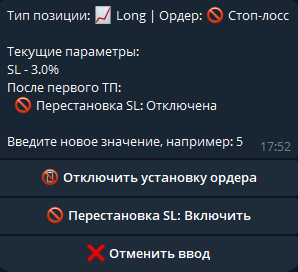

Specify a single value - the level for placing the stop-loss. It is set as a trigger market order. Previously, limit orders were used, but with limit trigger orders, there is a risk of non-execution, which is critical for stop-losses.

Pay attention to the Replace SL setting. When enabled, you can define a new position for the stop-loss order once a grid take-profit (which we discussed earlier) is triggered. This allows you to move the SL order to break-even (by setting a deviation of 0) or any other preferred level after a TP order is executed.

This menu allows you to manage your exchange connections, as well as save or delete the API keys used to encrypt your connection session. To connect an exchange, you must first enter your API keys.

If you do not have them yet, you will need to generate them on the exchange’s website.

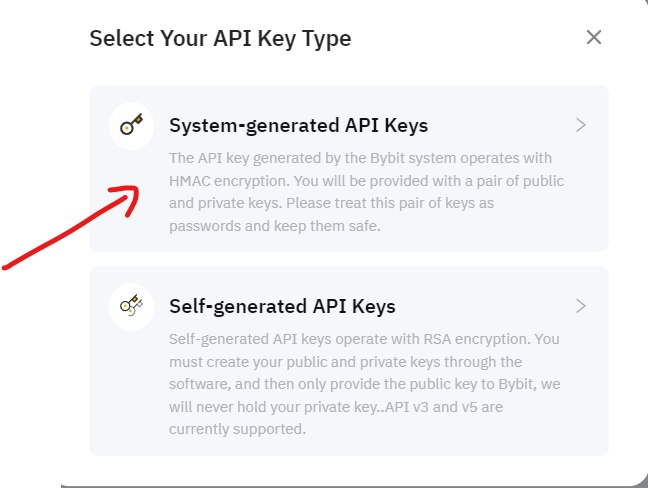

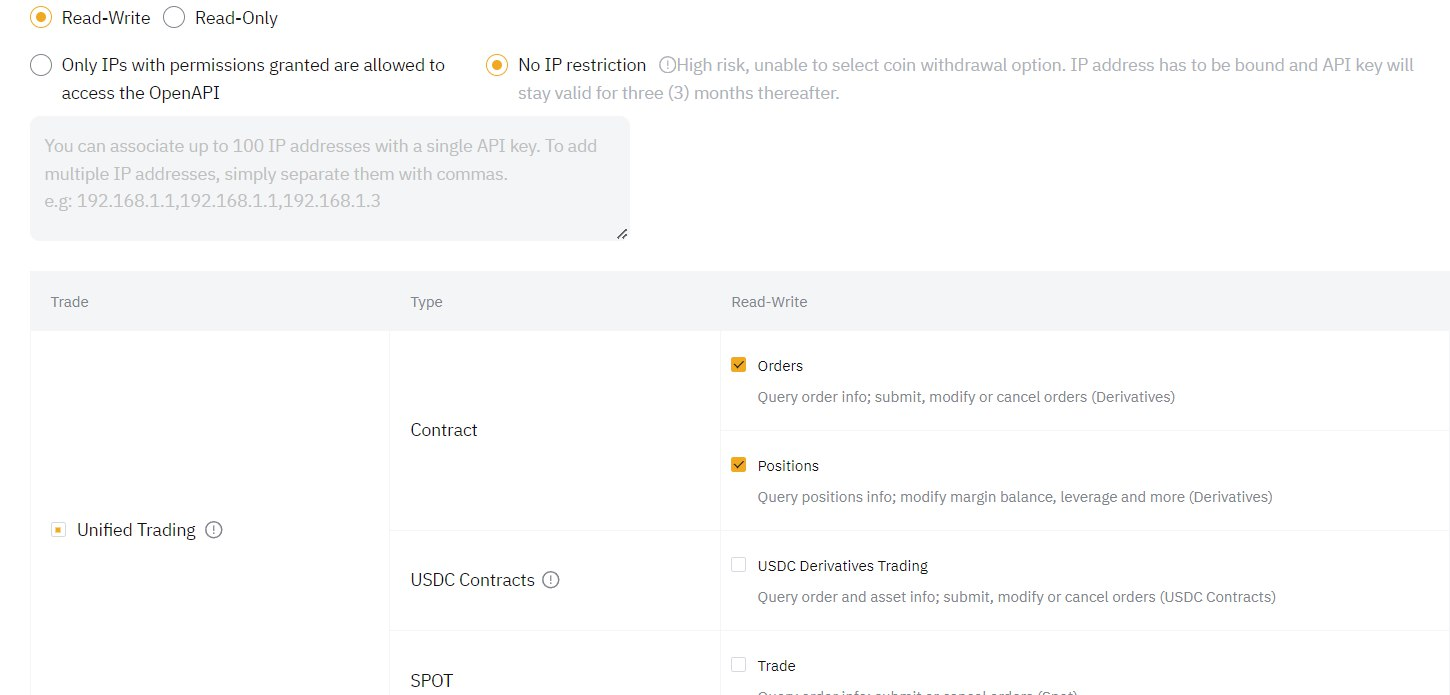

Please read the following instructions carefully. Click on Markets Menu and select "Create API Keys". Here, you will need to choose the exchange you wish to connect.We will use Bybit as an example for our key creation recommendation. Bybit offers the option to create Sub-accounts (typically used for copy-trading). You can create a sub-account or trade from your main account—the choice is yours. Once your account is ready, deposit a minimum amount and generate your keys in the API Management menu (bybit.com/app/user/api-management) by clicking "Create New Key".

When creating your keys, pay close attention to the "Assets" section. Ensure that no boxes are checked in this category. If enabled, these permissions could allow funds to be withdrawn from your account. Although your keys are stored in our database in an encrypted format, we prioritize your security—so only select permissions related ONLY to trading.

Once created, you will receive a pair of keys: API-KEY and API-SECRET (some exchanges may provide additional parameters). Make sure to save them in a secure place.

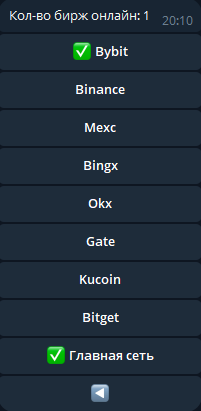

Click "Set API Keys", select your exchange, and enter your API Key followed by your Secret Key. After that, go to the Exchange Management menu and select the exchange you wish to connect. Upon a successful connection, a green checkmark will appear next to the exchange name, and a notification displaying your current available balance will be shown below.

Testnet (Demo Trading) Please note that you can also generate keys within the exchange's Testnet to trade using a "demo balance." The process for generating and entering these keys is exactly the same, except you must select "Testnet" when connecting.

Note: The bot previously offered spot trading, but this feature has been removed due to low demand.